"The free market failed."

"Greedy businessmen have ruined us all."

"The age of capitalism is over."

Such are the explanations that surround the collapse of the financial and real estate markets from 2007 to 2008, shortly followed by a nationwide recession. Big banks and speculators had made too many risky investments, we are told, and lost their fortunes, putting at risk the entire economy. At the surface this is indeed what took place to set up the crisis. The whole truth, however, requires far more than a surface-level understanding of the boom and bust of the 2000's. To gain an understanding of what happened during the economic bust, one must first understand what took place beforehand--the economic boom

This is the second of a three-part series detailing the complete failure of government intervention and the innocence of the free market in the buildup to the current economic crisis. Part I can be found here.

The Next Big Thing

Beginning in the 1990's, the Federal Government embarked on a campaign to make housing more affordable for low-income families and individuals via increased regulation to enforce lower lending standards. Loads of politicians and activists, eager to leave their mark during their time in D.C., hopped on board the affordable-housing train and enacted (or re-enacted) a host of regulation in the financial and housing sectors.

The Community Reinvestment Act

Chief among these new regulations was the Community Reinvestment Act (CRA). Born in the Carter administration to force banks to give more loans to potential homebuyers who otherwise would not be able to afford a home, it was resurrected during the Clinton administration and strengthened so it had even more authority over real estate and lending. The act exposed banks to lawsuits if they did not meet high quotas of minority and lower-class customers, lawsuits with hefty fines and fees.

Fannie and Freddie...Again

In conjunction with the Community Reinvestment Act, Fannie Mae and Freddie Mac began in September 1999 to lower its standards for creditworthiness in the homebuyers that banks gave loans to. As a result, banks began giving more and more loans to people whose credit was not normally up to par, and Fannie and Freddie got more loans to buy, repackage, and sell as mortgage-backed securities to investors. Banks then had even more money to use in even more subprime loans.

Executive Lenience

Andrew Cuomo and Henry Cisneros, who were secretaries of President Clinton's Department of Housing and Urban Development, both lowered mandatory restrictions on loans from private lending institutions; Cuomo even went so far as to bring vicious legal charges on banks that didn't meet his standards for what even he admitted was "affirmative action."

Political pressure ultimately led to lowered standards in the banking industry; suddenly, anyone could get a mortgage, and "anyone" included those who simply could not afford to buy a house, with or without a loan. Demand for housing skyrocketed, suppliers surged into the real estate sector, and prices shot upward. This upward turn, however, would have been merely a blip on the economic radar of history if not for the misguided, unscrupulous, and sometimes downright sinister actions of the Federal Reserve, the central bank of the United States. While the housing bubble would indeed have taken place without the Federal Reserve, the intensity of the boom and subsequent bust were created by this institution's actions, which will be detailed in part III.

Monday, December 28, 2009

Wednesday, December 23, 2009

The Market is Innocent, Part I

"The free market failed."

"Greedy businessmen have ruined us all."

"The age of capitalism is over."

Such are the explanations that surround the collapse of the financial and real estate markets from 2007 to 2008, shortly followed by a nationwide recession. Big banks and speculators had made too many risky investments, we are told, and lost their fortunes, putting at risk the entire economy. At the surface this is indeed what took place to set up the crisis. The whole truth, however, requires far more than a surface-level understanding of the boom and bust of the 2000's. To gain an understanding of what happened during the economic bust, one must first understand what took place beforehand--the economic boom

This is the first of a three-part series detailing the complete failure of government intervention and the innocence of the free market in the buildup to the current economic crisis.

Boom and Bust

Normally, there are two parties principally involved in the process of purchasing a house: the buyer and a lending institution of some sort. The buyer, unless he is filthy rich, needs to get a loan with which to buy the house, and the lending institution is more than willing to provide him with that loan, with interest. The buyer takes the loan, buys a house, and spends several years slowly paying the mortgage.

The times from 1998 to 2006, however, were not "normal." Housing prices increased dramatically. Houses became the "best investment," because "they never lose value." Speculators and house-flippers bought low and sold high, riding the waves of the economy. Precious few suspected the boom was merely a bubble, prone to popping at one point or another. Yet, despite the doubts of the vast majority, the minority was proven correct. In 2006, home prices and stocks began to decline, then freefall. By 2009, multiple bailouts of failing industries, "stimulus packages" for the groaning economy, and increased regulation of the financial industry were deemed necessary to "save capitalism."

Fannie and Freddie

Most everyone assumed that the collapse was due to the wild swings of a normal, free-market economy. Yet, as I stated before, nothing was normal in the usual sense of the word during the housing bubble. Government intervention ran rampant during this time period, and two key pieces to the government puzzle are the corporations known as Fannie Mae and Freddie Mac. These corporations, known as "government sponsored enterprises", were technically private but were given governmental powers over the housing market.

Their primary function was to purchase mortgages from lending institutions. Lending institutions would then receive a large sum of money up front, while Fannie and Freddie would receive the steady income from the debtor and hold responsibility for that loan and the possibility of default. Once Fannie and Freddie had accumulated a large number of loans, they would repackage them as "mortgage-backed securities." These were essentially several loans bundled together and sold on the market to investors. Critical to these securities was the diversity of the loans packaged inside them; there had to be a wide variety of loans, some safe, others much riskier.

Absolute Power

Despite the fact that the risky loans were packaged together with the good loans, the security as a whole was considered to be safe, or "AAA", by investors and advisers. Why? Political pressure from various government branches pushed independent rating agencies to certify those risky investments in order to stimulate more homebuying; the more mortgage-backed securities sold on the market, the more money banks got from Fannie and Freddie, the more loans those banks could make to potential homeowners.

As will be detailed in Parts II-III of this series, this pressure placed on private rating agencies is just the beginning; political power in its various forms, from Fannie and Freddie to regulation to monetary policy, formed the bedrock of the boom and subsequent bust, and will likely shape the global economy for decades to come.

"Greedy businessmen have ruined us all."

"The age of capitalism is over."

Such are the explanations that surround the collapse of the financial and real estate markets from 2007 to 2008, shortly followed by a nationwide recession. Big banks and speculators had made too many risky investments, we are told, and lost their fortunes, putting at risk the entire economy. At the surface this is indeed what took place to set up the crisis. The whole truth, however, requires far more than a surface-level understanding of the boom and bust of the 2000's. To gain an understanding of what happened during the economic bust, one must first understand what took place beforehand--the economic boom

This is the first of a three-part series detailing the complete failure of government intervention and the innocence of the free market in the buildup to the current economic crisis.

Boom and Bust

Normally, there are two parties principally involved in the process of purchasing a house: the buyer and a lending institution of some sort. The buyer, unless he is filthy rich, needs to get a loan with which to buy the house, and the lending institution is more than willing to provide him with that loan, with interest. The buyer takes the loan, buys a house, and spends several years slowly paying the mortgage.

The times from 1998 to 2006, however, were not "normal." Housing prices increased dramatically. Houses became the "best investment," because "they never lose value." Speculators and house-flippers bought low and sold high, riding the waves of the economy. Precious few suspected the boom was merely a bubble, prone to popping at one point or another. Yet, despite the doubts of the vast majority, the minority was proven correct. In 2006, home prices and stocks began to decline, then freefall. By 2009, multiple bailouts of failing industries, "stimulus packages" for the groaning economy, and increased regulation of the financial industry were deemed necessary to "save capitalism."

Fannie and Freddie

Most everyone assumed that the collapse was due to the wild swings of a normal, free-market economy. Yet, as I stated before, nothing was normal in the usual sense of the word during the housing bubble. Government intervention ran rampant during this time period, and two key pieces to the government puzzle are the corporations known as Fannie Mae and Freddie Mac. These corporations, known as "government sponsored enterprises", were technically private but were given governmental powers over the housing market.

Their primary function was to purchase mortgages from lending institutions. Lending institutions would then receive a large sum of money up front, while Fannie and Freddie would receive the steady income from the debtor and hold responsibility for that loan and the possibility of default. Once Fannie and Freddie had accumulated a large number of loans, they would repackage them as "mortgage-backed securities." These were essentially several loans bundled together and sold on the market to investors. Critical to these securities was the diversity of the loans packaged inside them; there had to be a wide variety of loans, some safe, others much riskier.

Absolute Power

Despite the fact that the risky loans were packaged together with the good loans, the security as a whole was considered to be safe, or "AAA", by investors and advisers. Why? Political pressure from various government branches pushed independent rating agencies to certify those risky investments in order to stimulate more homebuying; the more mortgage-backed securities sold on the market, the more money banks got from Fannie and Freddie, the more loans those banks could make to potential homeowners.

As will be detailed in Parts II-III of this series, this pressure placed on private rating agencies is just the beginning; political power in its various forms, from Fannie and Freddie to regulation to monetary policy, formed the bedrock of the boom and subsequent bust, and will likely shape the global economy for decades to come.

Saturday, December 5, 2009

Spending and Slavery

Starting in December 2007, the United States entered a recession that soon affected the entire industrialized world. Fierce debate has surrounded the Federal Government's response to this downturn. In addition to adjusting financial regulations and monetary policy, the Bush Administration proposed a bill called the Emergency Economic Stabilization Act allowing for $700 billion of assets to be bought from failing banks; the legislation easily passed through Congress. Later, the Obama administration passed the American Recovery and Reinvestment Act through Congress, a $787 billion "stimulus" package, in addition to extending credit to failing automakers even to the point of nationalizing General Motors.

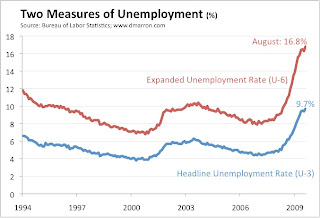

While the Obama administration predicted that the unemployment rate from the recession would never get higher than 8.1% thanks to his and his predecessor's spending(1), the official unemployment rate had leaped up to 9.7% by August 2009, and unofficial studies said the rate was actually 16.8%, over twice as high as the original estimates(2). What happened? Why did the government spending fail to improve economic conditions?

First, proponents of Keynesian spending (such as Bush's and Obama's) fail to realize that government spending to "create or save" jobs only creates temporary employment. Unemployed people who are put to work thanks to government projects such as highways and other infrastructure will work for a few months, then suddenly be back out of a job again after the spending on that project stops. As a result, jobs created thanks to the government are never permanent unless the spending is also permanent.

Second, any government's spending is vulnerable to corruption and abuse. In November 2009, a massive scandal erupted regarding the locations where the Federal government had put the stimulus money from the ARRA. At the White House's own website, recovery.gov, reports could be found of stimulus money going to congressional districts that didn't even exist. Billions went to places such as the "0th District of New Hampshire" and the "15th District of Arizona", which are completely nonexistent(3). This is to be expected when a group of individuals with special interests, such as politicans, are given the authority to deal with large amounts of money.

Lastly, Keynesianism ignores the fact that private investment is much more effective than government investment. Because the government is rarely subjected to a price mechanism as often as the private sector and does not necessarily need to balance its budget, the government can spend and spend and spend without having the slightest impact on the economy. Private individuals, who have a bottom line to meet and a budget to follow, are more likely to target the places they spend and invest in with care, doing business with ventures that provide superior products and services or are most likely to succeed and therefore deserve investment most, while leaving badly-run businesses to fail.

In light of this last observation on private investment, tax cuts provide an excellent mechanism for the private sector to invest more money during an economic downturn. Tax cuts also provide benefits aside from leading to more efficient investments. First, tax cuts provide a 100% assurance that people will be able to spend on things that they want. If the ultimate purpose of growing an economy is to improve the quality of life of a large portion of the populace, tax cuts are the most definite way of doing so.

Finally, tax cuts give back to the people what is already theirs. Stealing is considered morally reprehensible in nearly every culture, yet it is somehow excused when it is done by government and approved by at least 51% of the people. Yet the presence of a government changes nothing; taking someone's hard-earned private property is stealing regardless of whether the thief wears a mask and lives on the streets or wears a suit and works for the IRS. There are indeed benefits to government such as public services and the defense of justice that can only take place with taxation, but they are still funded by wholesale robbery that should be kept to a minimum. The morality and economic practicality of tax cuts simply go to show, once again, that a hands-off approach to the economy and indeed to society as a whole is both the most practical in terms of improving quality of life and the most moral in that it recognizes private property. Liberty is, and always will be, the best policy for a government to follow.

1. http://www.whitehouse.gov/omb/assets/fy2010_new_era/Summary_Tables2.pdf

2. http://voices.washingtonpost.com/economy-watch/2009/09/actual_unemployment_rate_hits.html

3. http://abcnews.go.com/Politics/jobs-saved-created-congressional-districts-exist/story?id=9097853

Friday, December 4, 2009

Guns and Butter, Round Two

In the tumultuous presidency of Lyndon Baines Johnson, politicos typically referred to Johnson's twin policies of increased intervention in Vietnam and expanded social programs as "guns and butter." While the financial toll of these two fronts separately may have been steep, but bearable, both of them put together brought the American economy to its knees, putting the entire country through a steep slump.

A mere 10 months into his administration, President Barack Obama faces a similar decision: he fights a war allegedly critical to national security in the wilderness of Afghanistan while pushing for health care reform in the even wilder Washington, D.C.. Obama recently called for 30,000 additional troops to be sent into Afghanistan, bringing the total troop level in that country to approximately 98,000, while the level of private contractors is roughly 104,000. On top of it all, official estimates of the $30 billion cost of the buildup is cause for major concern.

Lost in all these big numbers is the little fact that there may very well be fewer than 100 members of Al Qaeda in all of Afghanistan. Add the $30 billion for the troop surge plus the $65 billion already being spent annually on the war in Afghanistan, and do the math: the United States is spending--wait for it-- $950 million per Al Qaeda operative in Afghanistan, per year.

On the home front, the Congressional Budget Office has warned Senate and House Democrats that their proposed health care overhaul will raise costs, not reduce them, and add to the already heavy financial burden. The estimated cost of $1.5 trillion over a decade can only be paid for by raising taxes, borrowing money, or inflating the currency, all three of which are bad options for a president overseeing an economy badly in need of a boost.

All these costs will add to the record $1.8 trillion deficit forecast for the year 2010. Add on to all this gloom and doom the $12 trillion-and-counting national debt and our untold trillions in unfunded liabilities from programs like Medicare and Social Security, and suddenly Obama's war in Afghanistan and health care proposal don't seem like such good ideas even separately, much less combined.

Johnson tried too hard to force his statist agenda on America, and it very nearly broke the country's back. Obama must escape his fantasyland which history can be ignored, and stop to consider the consequences of enacting not one, but two massively expensive programs which, depending on who you ask, are probably not worth the cost even if enacted in better circumstances.

Subscribe to:

Posts (Atom)