"The free market failed."

"Greedy businessmen have ruined us all."

"The age of capitalism is over."

Such are the explanations that surround the collapse of the financial and real estate markets from 2007 to 2008, shortly followed by a nationwide recession. Big banks and speculators had made too many risky investments, we are told, and lost their fortunes, putting at risk the entire economy. At the surface this is indeed what took place to set up the crisis. The whole truth, however, requires far more than a surface-level understanding of the boom and bust of the 2000's. To gain an understanding of what happened during the economic bust, one must first understand what took place beforehand--the economic boom

This is the second of a three-part series detailing the complete failure of government intervention and the innocence of the free market in the buildup to the current economic crisis. Parts I and II can be found here and here.

The Fed

In 1913, the Federal Reserve Act was passed by Congress and signed into law by President Woodrow Wilson. The Act created the Federal Reserve System, a central bank for the United States. The purpose of the Federal Reserve, colloquially known as "the Fed", was to stabilize the economy, particularly in the financial sector, by orchestrating controls over the supply and demand of money, also known as implementing "monetary policy." While the Federal Reserve Act was signed into law with good intentions, the Fed has since its inception been a horrific failure at achieving its goals of economic stability.

Business Cycle Goes Vroom

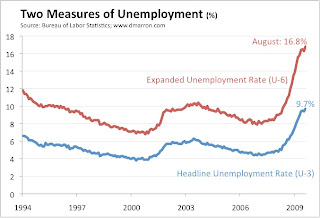

The business cycle is the wave-like motion the economy often seems to take; first, the economy is growing. Booming. Skyrocketing. Suddenly, however, the party comes to an abrupt stop. The economy shrinks down to normal size, unemployment rises, and poverty increases. Consumers slink back to reality, wondering how they could have thought the upward rise could last forever.

Economists have argued that the business cycle is a fact of life in capitalism. "It's something that just happens," they say, "like the coming of the tides or the crowing of the rooster." On the contrary, however, while slight upturns and downturns are a normal thing in a capitalist economy, the dramatic rises and falls that are associated with the business cycle are due to a decidedly un-capitalistic factor: expanded money supply, which takes place when a central bank or other regulatory agency forces the amount of money in circulation beyond normal levels in an attempt to spur on consumption and prosperity. The Federal Reserve, as the acting central bank of the United States, is the primary source of an expanded money supply.

The first main example of the Federal Reserve's harmful interventions into the economy takes place in the Roaring 20's and the subsequent Great Depression. Through the 1920's, the Federal Reserve increased the raw amount of money in circulation by over 60%. This increase in the amount of money available spurred spending and production; investors had plenty of new capital to invest in new businesses, consumers were able to buy more products, and economists proclaimed the world economy to be on a new path of prosperity and peace.

The "prosperity" created by the expansion of the money supply was an illusion, however. All the newly available capital meant that businesses that normally never would have gotten off the ground due to inefficiency and lack of productivity were able to stand for a while. In addition to this, borrowing and spending must be backed up by saving and producing, while all the spending and consumption started in the 1920's essentially created a house of cards; one small error and the entire economy would collapse. That error came in 1929; the stock market slowly began to tumble, then freefall as investors realized that they had made too many investments, and that their investments were largely placed in very, very sick enterprises. Businesses began to fail, investors lost their money, and consumers lost their buying power.

Round and Round We Go Again

If the situation described above sounds eerily similar to the one the economy is currently in as of this writing, it's because it is. Throughout the late 1990's and early 2000's, the Federal Reserve manipulated interest rates to spur new borrowing for homeowners. Families that previously were unable to get a loan for a new home now found themselves able to purchase houses normally available only to the upper and middle classes. Construction companies and mortgage banks raked in enormous profits as business boomed.

Everything looked fine and dandy. Families had homes, companies made money, and everybody seemed happier. But underneath the surface, trouble loomed, as it always does. Right around the corner was an economic crisis so large that some would proclaim it the next Great Depression. Suddenly, the world would be forced to take off its rose-colored glasses and see the rotten, infested foundation of the American economy.

The housing market peaked in 2006; prices slowly began to seep downward, then freefall into 2007. In an attempt to prop up failing corporations, the federal government began to "bail out" various enterprises with billions upon billions of taxpayer money. The Federal Reserve began to lower interest rates even further, trying to stave off financial collapse. Both outgoing President George Bush and incoming President Barack Obama passed massive spending legislation to stimulate the economy.

Blame spewed from the mouths of every politico and commentator with someone to talk to; most of the blame centered "irresponsible bankers" and "predatory lending" and "financial deregulation". Sadly, very little of the blame was directed upon the root causes of the crisis: over-regulation of the financial sector, well-meaning housing initiatives, and ultimately the Federal Reserve. So few wish to focus on these institutions because of their role in bringing the happy times of the economic boom--indeed, they wish for them to bring the boom back-- but the truth of the matter is that the prosperity that America held in its hands for the better part of that decade was a sham, a sham that could only result in a collapse. Unfortunately, unless the federal government turns its path away from loose monetary and fiscal policy, the cycle of boom and bust will only continue. There is hope, however: Americans are waking up to the massive fraud of the current economic system. If the American people rise up and demand true revolution (not the phony hope-and-change jingle), the nation may very well return to a solid policy of economic liberty and prosperity.