Starting in December 2007, the United States entered a recession that soon affected the entire industrialized world. Fierce debate has surrounded the Federal Government's response to this downturn. In addition to adjusting financial regulations and monetary policy, the Bush Administration proposed a bill called the Emergency Economic Stabilization Act allowing for $700 billion of assets to be bought from failing banks; the legislation easily passed through Congress. Later, the Obama administration passed the American Recovery and Reinvestment Act through Congress, a $787 billion "stimulus" package, in addition to extending credit to failing automakers even to the point of nationalizing General Motors.

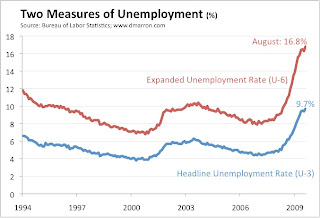

While the Obama administration predicted that the unemployment rate from the recession would never get higher than 8.1% thanks to his and his predecessor's spending(1), the official unemployment rate had leaped up to 9.7% by August 2009, and unofficial studies said the rate was actually 16.8%, over twice as high as the original estimates(2). What happened? Why did the government spending fail to improve economic conditions?

First, proponents of Keynesian spending (such as Bush's and Obama's) fail to realize that government spending to "create or save" jobs only creates temporary employment. Unemployed people who are put to work thanks to government projects such as highways and other infrastructure will work for a few months, then suddenly be back out of a job again after the spending on that project stops. As a result, jobs created thanks to the government are never permanent unless the spending is also permanent.

Second, any government's spending is vulnerable to corruption and abuse. In November 2009, a massive scandal erupted regarding the locations where the Federal government had put the stimulus money from the ARRA. At the White House's own website, recovery.gov, reports could be found of stimulus money going to congressional districts that didn't even exist. Billions went to places such as the "0th District of New Hampshire" and the "15th District of Arizona", which are completely nonexistent(3). This is to be expected when a group of individuals with special interests, such as politicans, are given the authority to deal with large amounts of money.

Lastly, Keynesianism ignores the fact that private investment is much more effective than government investment. Because the government is rarely subjected to a price mechanism as often as the private sector and does not necessarily need to balance its budget, the government can spend and spend and spend without having the slightest impact on the economy. Private individuals, who have a bottom line to meet and a budget to follow, are more likely to target the places they spend and invest in with care, doing business with ventures that provide superior products and services or are most likely to succeed and therefore deserve investment most, while leaving badly-run businesses to fail.

In light of this last observation on private investment, tax cuts provide an excellent mechanism for the private sector to invest more money during an economic downturn. Tax cuts also provide benefits aside from leading to more efficient investments. First, tax cuts provide a 100% assurance that people will be able to spend on things that they want. If the ultimate purpose of growing an economy is to improve the quality of life of a large portion of the populace, tax cuts are the most definite way of doing so.

Finally, tax cuts give back to the people what is already theirs. Stealing is considered morally reprehensible in nearly every culture, yet it is somehow excused when it is done by government and approved by at least 51% of the people. Yet the presence of a government changes nothing; taking someone's hard-earned private property is stealing regardless of whether the thief wears a mask and lives on the streets or wears a suit and works for the IRS. There are indeed benefits to government such as public services and the defense of justice that can only take place with taxation, but they are still funded by wholesale robbery that should be kept to a minimum. The morality and economic practicality of tax cuts simply go to show, once again, that a hands-off approach to the economy and indeed to society as a whole is both the most practical in terms of improving quality of life and the most moral in that it recognizes private property. Liberty is, and always will be, the best policy for a government to follow.

1. http://www.whitehouse.gov/omb/assets/fy2010_new_era/Summary_Tables2.pdf

2. http://voices.washingtonpost.com/economy-watch/2009/09/actual_unemployment_rate_hits.html

3. http://abcnews.go.com/Politics/jobs-saved-created-congressional-districts-exist/story?id=9097853

No comments:

Post a Comment