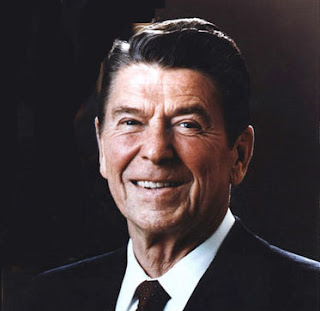

Every day, thousands of conservatives think back on the man named Ronald Reagan, the one who brought back traditional values, toppled the evil empire, and above all, lowered taxes...and smile fondly at the memory. The first two points may be written on in later articles, but I have some serious issues with the third point. Let me explain.

Every day, thousands of conservatives think back on the man named Ronald Reagan, the one who brought back traditional values, toppled the evil empire, and above all, lowered taxes...and smile fondly at the memory. The first two points may be written on in later articles, but I have some serious issues with the third point. Let me explain.Aside from the fact that Reagan didn't actually cut taxes, the main problem with this hero-worship is that it ignores Reagan's spending policies, a problem common among conservatives. Ronald Reagan left office having incurred the largest federal debt the United States had ever seen. Yet this clear clash with traditional "fiscal conservatism" is routinely ignored or downplayed by conservatives. Why?

The answer lies in the new breed of fiscal conservatism that has been growing for several decades. This new species of economic thought considers budget deficits trivial compared to tax levels. A government can, according to this philosophy, spend itself into debt as long as taxes are low and still consider itself a "small government", because the measure of a government's size is not what it gives out in the form of spending but what it takes in from taxation.

This view ignores one crucial fact, however. Every dollar a government spends must be paid for in some way, either in the present or in the future. If the government opts not to pay now through taxation, it must borrow the money and pay later. This debt can be handled in one of three ways: taxation, inflation, or inaction. If the government chooses to pay the debt through taxation, then the spending has consequences that included higher taxes anyway. What was the point of the deficit spending if not to simply push the payment for it back by several years? If the government chooses to pay the debt by inflation, no money is directly taken from any taxpayers, but the value of the money they possess is decreased, making inflation at least equivalent in cost to taxation for all practical purposes. If the government decides to not pay the debt at all, investors' willingness to invest in that country decreases, thereby leading to the same consequence as inflation: a devalued currency.

Add to these facts the issue of interest on the debt, and suddenly deficit spending does not appear so attractive. Every time a government attempt to spend without paying for it, the payment later on in the future will inevitably be greater. The simple solution is to either cut spending or raise taxes to meet that spending; the long-term economic pain will be much, much less.

P.S. Yes, I did use an article from Paul Krugman

No comments:

Post a Comment